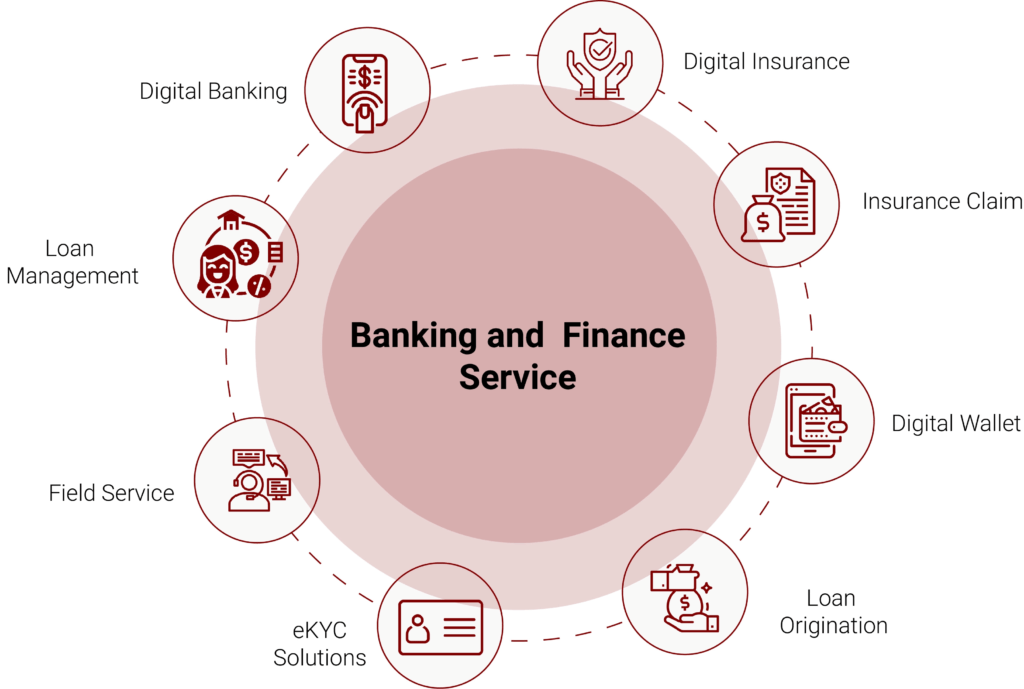

Your Source for Banking and Finance Service Excellence

We help banks challenge their conventions; capitalize on the full potential of technology, their people and emerging opportunities; and become better at change

-

CybersecurityRobust IT systems are essential to protect against cyber threats and maintain trust.

-

Digital TransformationIT is at the heart of this transformation, making banking more accessible and convenient.